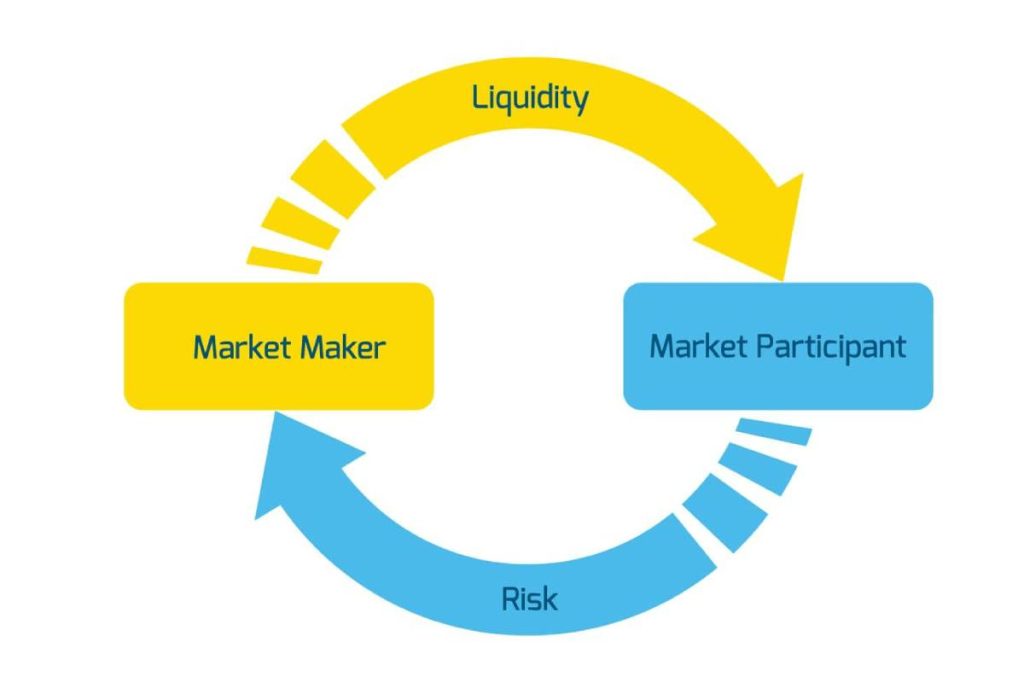

Market makers are firms that provide liquidity in the futures market. They facilitate the trading of futures contracts, including stocks, options, EFP, and commodities. As such, they have played an important role in improving liquidity and pricing efficiency.

Generally, market makers have two motivations: to reduce the spread and to increase the liquidity of the market. By reducing the spread, they minimize the costs of the trades for traders and investors. However, they can also make a loss. If they are losing, they have to pay a margin call, which is a fee that is used to cover their losses. Market makers are professionals and may use derivatives to manage their risk.

Some market makers are required to respond to quote requests, which is a process that ensures that their positions are filled at a fair price. This helps to enhance liquidity in lightly traded futures contracts. These include the Micro Emini and Metals futures. Additionally, market makers are responsible for collecting inventory and ensuring that their positions are matched at the correct price. Moreover, they can be compensated for fulfilling these obligations.

While the requirements vary from firm to firm, most market making firms operate under certain rules. The firm must meet specific criteria to be approved by the exchange. A list of eligible firms is available, which includes firms that accept customer calls, FX options, Exchange-for-Physical trades, and Security Futures market making. In addition, some electronic exchanges have the ability to authorize an unlimited number of market makers.

Although the definition of market making can be very broad, the main goal of most market makers is to improve the liquidity of a particular market. To do this, they act as a bridge between buyers and sellers. With this, they make the trading process easier for both institutional and retail traders. They also make sure that the product’s price is fair and that all interested parties can buy or sell at a fair price.

Compared with a retail trader, a market maker does not have the same level of knowledge regarding the futures market. Hence, they do not know what the price will be in the future. Instead, they use derivatives to help them manage their risk.

Because of this, they can only take a small amount of risk with their capital. However, they can earn higher returns if they use leverage. For example, a farmer who is selling corn may hedge his price risk with a derivative. Similarly, a professional money manager may be selling stock to rebalance his portfolio.

Since their inception, market makers have helped to improve the liquidity and stability of the relevant markets. Currently, there are a number of companies that offer market making services in the futures market. Each has its own motives and requirements. Nonetheless, a market maker can be an essential part of a portfolio. So, if you are looking to diversify your investments, it might be worth considering a market maker in your portfolio.